Rumored Buzz on Paul B Insurance

Much like private health and wellness insurance strategies, which we'll chat about next, federal health insurance coverage programs attempt to handle top quality as well as prices of treatment, in an initiative to provide decreased prices to the insured. All medical insurance strategies are designed to help you save money on healthcare costs. People with this kind of insurance policy are still responsible for costs of care, like premiums, deductibles, as well as various other out-of-pocket expenditures They may not be as high as with other kinds of insurance.

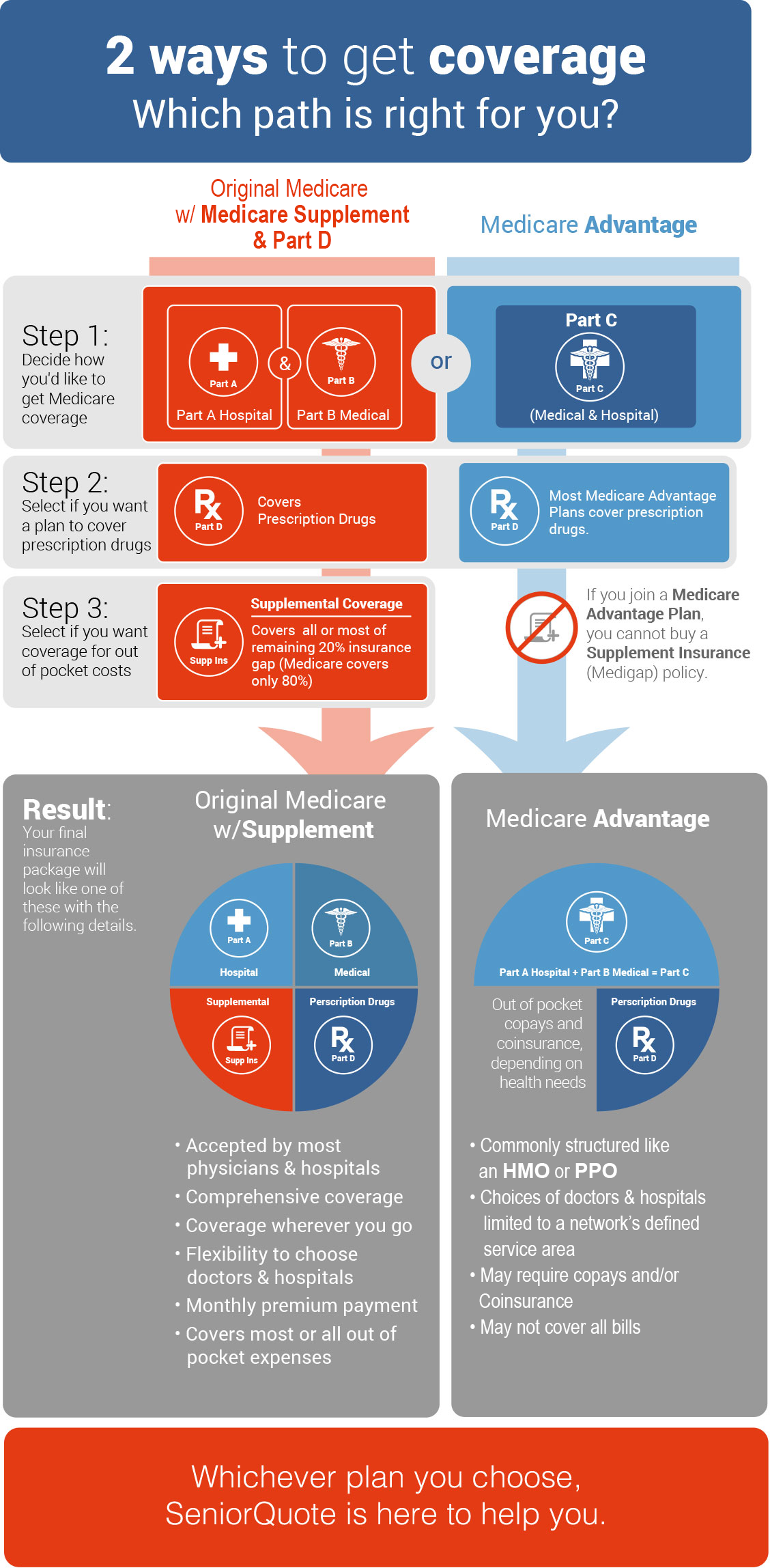

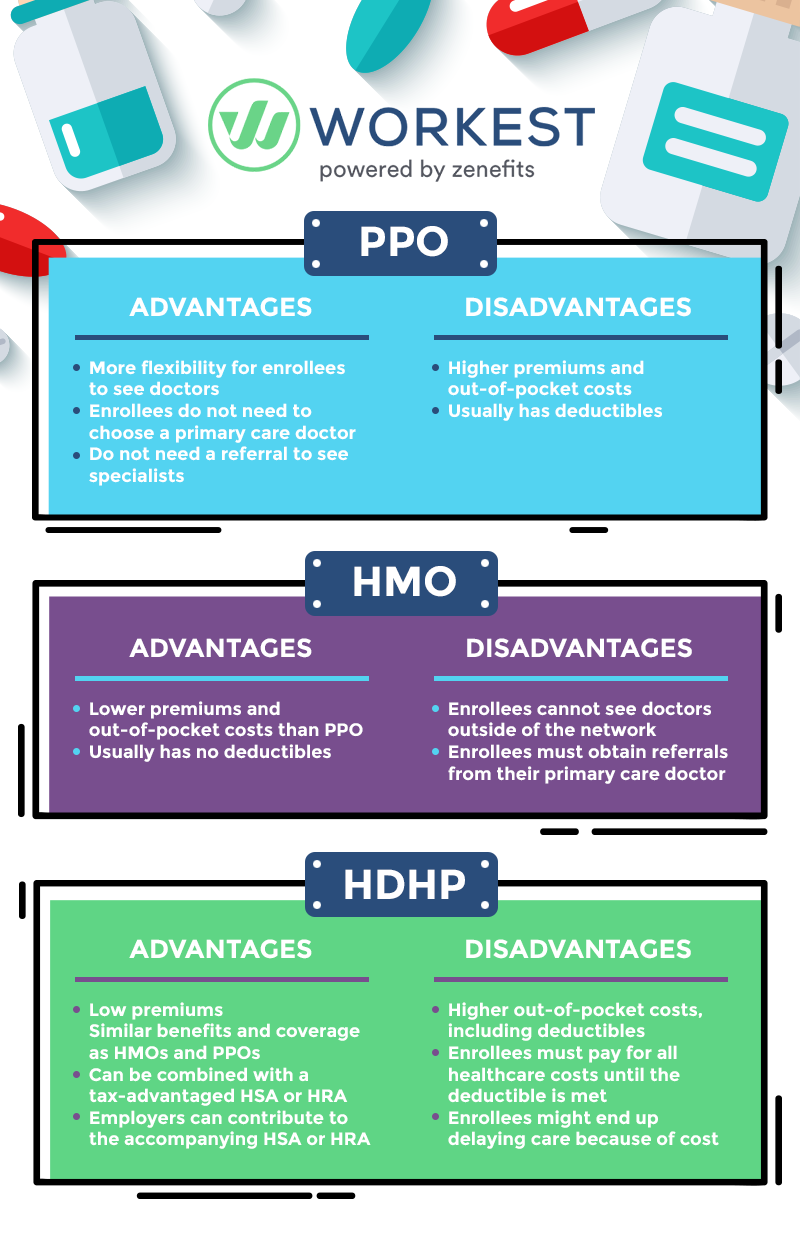

After you've identified the primary kind of wellness insurance based upon its resource, you can better classify your insurance coverage by the kind of strategy. A lot of wellness insurance policy plans are taken care of care strategies, which just indicates the insurance coverage business deal with various clinical providers to develop and also negotiate prices and also high quality of treatment.

Some Known Facts About Paul B Insurance.

But the deductibles, and also other out-of-pocket prices like copayments as well as coinsurance for a health insurance plan will differ based on your insurer and also just how much care you look for. A high-deductible health insurance plan (HDHP), which enables the guaranteed person to open up an HSA account, may be an HMO with one insurance company, and an EPO with an additional.

Some kinds of wellness insurance, like temporary strategies, do not offer thorough protection as outlined by the Affordable Care Act and also hence are not regulated by it either. Short term wellness insurance is not thought about a form of major clinical insurance policy, but only a stopgap procedure meant to cover a few, but not all, clinical expenditures. Still, picking health and wellness insurance coverage can be hard work, also if you're picking a strategy through your employer. There are a great deal of complex terms, and also the procedure forces you to think difficult regarding your health and your finances. Plus you have to navigate all of it on a deadline, typically with just a few-week duration to discover your alternatives and also make choices.

Asking on your own a couple of straightforward questions can aid you no in on the ideal strategy from all those on the marketplace. Right here are some pointers on where to look and also just how to obtain credible suggestions and also aid if you require it. It's not constantly apparent where to try to find medical insurance.

, where you can shop for insurance in the industries developed by the Affordable Treatment Act, likewise known as Obamacare.

The Greatest Guide To Paul B Insurance

Even with dozens of options, you can tighten things down with some basic inquiries, De, La, O claims. If you're quite healthy, any of a selection of strategies may work.

"If there's a strategy Check Out Your URL that does not have your supplier or your medicines in-network, those can be eliminated," he claims. Often you can enter in your medications or medical professionals' names while you browse for plans online to remove plans that won't cover them. You can also simply call the insurer and also ask: Is my provider in-network for this strategy I'm considering? Is my medication on the strategy's formulary (the checklist of medications an insurance plan will cover)? There are additionally 2 major various kinds of strategies to consider.

If you selected that plan, you 'd be betting you won't need to utilize a great deal of health services, and also so would only have to bother with your ideally cost effective premiums, and also the expenses of a few appointments. If you have a persistent medical problem or are simply more threat averse, you may rather select a strategy that has actually dialed up the quantity of the premium.

Some Ideas on Paul B Insurance You Need To Know

This way, you can go to a great deal of consultations and pick up a whole lot of prescriptions and still have manageable regular monthly prices. Which plans are readily available and affordable to you will vary a whole lot depending read this post here on where you live, your income as well as that remains in your household as well as on your insurance coverage plan.

Still feeling overwhelmed with all the ACA choices? There is free, impartial professional assistance available to help you choose and also enroll in a plan. Aaron De, La, O is one such navigator, and keeps in mind that he and also his fellow guides do not work on compensation they're paid by the government.

The net can be a frightening place. Corlette states she warns individuals: Don't place your get in touch with details in health and wellness insurance passion types or click on on-line ads for insurance coverage!

"However, there are a lot of con artists out there that take advantage of the truth that individuals identify health insurance is something that they ought to obtain," states Corlette. She informs people: "Just go directly to Medical care.

The Best Strategy To Use For Paul B Insurance

This year, the register period for the Health, Care. gov marketplace intends that enter into impact in January 2022 begins Nov. 1, 2021 and also runs up until Jan. 15, 2022. If you're signing up for an employer-sponsored plan or Medicare, the deadlines will be different, yet possibly likewise in the fall.